What does this mean for me?

If you live outside of the EU and UK and are a Creator, YumyHub will collect the necessary VAT on your sales to UK/EU-based Fans and transfer it directly to the appropriate tax authorities. Right now, nothing further needs to be done. However, based on your unique circumstances, we advise you to obtain expert guidance to make sure you are in compliance with your local laws.

If you are a Creator residing in the EU, YumyHub will also collect the necessary VAT on sales made to Fans based in the UK or the EU and will then forward this information straight to the appropriate tax authorities. Right now, nothing further needs to be done. However, based on your unique circumstances, we advise you to obtain expert guidance to make sure you are in compliance with your local laws.

Additionally, if you are registered for EU VAT, please note that YumyHub is the recipient of the content you sell to them and that there is zero percent VAT applied to this. It should be taken into account when calculating your income taxes.

It depends if you are registered for VAT if you are a Creator residing in the UK.

When you must register for VAT is explained in the following HMRC guidance: https://www.gov.uk/vat-registration/when-to-register. To be clear, as stated in the guideline page, your Earnings (80% of Fans payment) are classified as “VAT Taxable Turnover.”

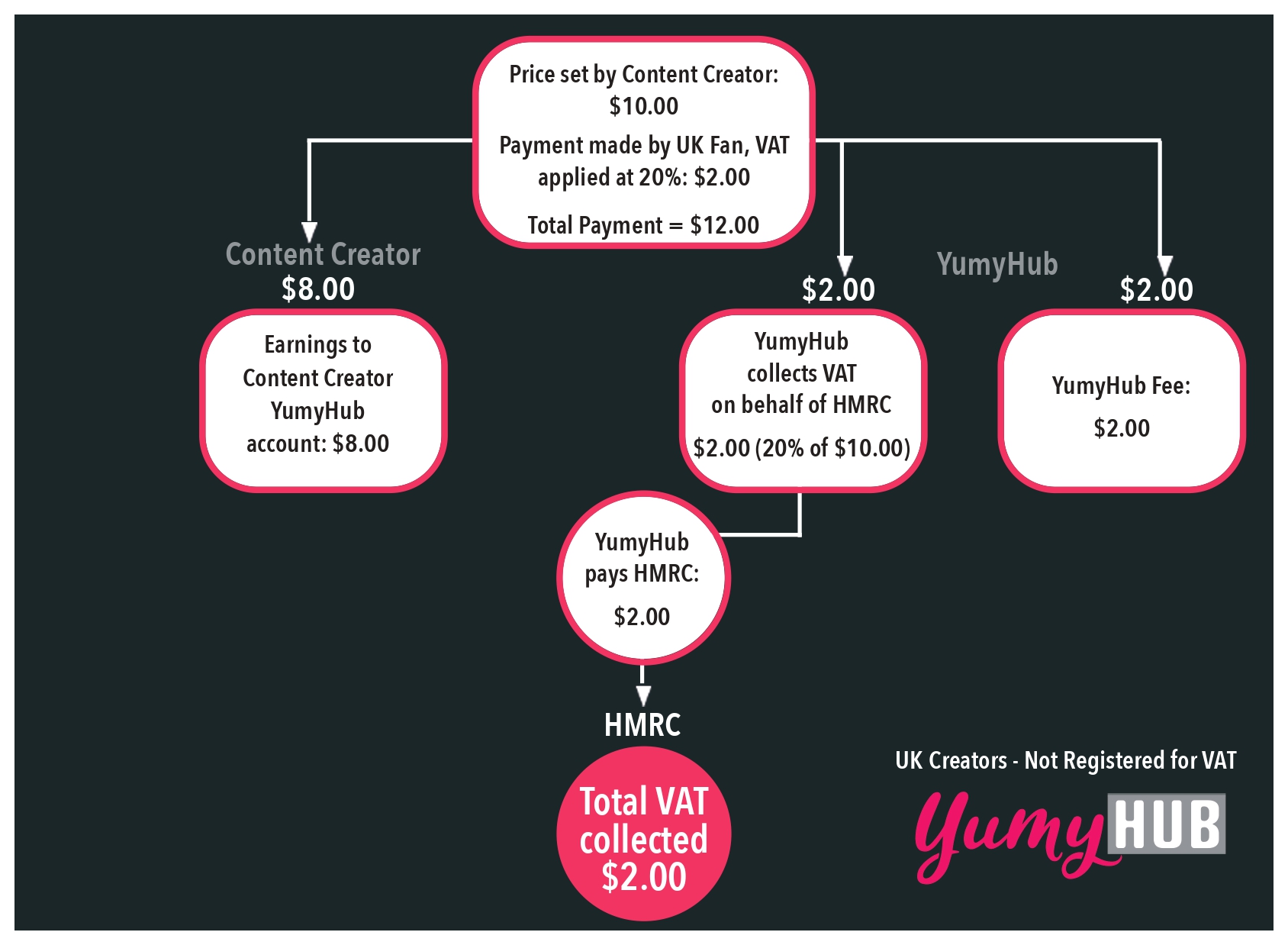

YumyHub will collect the necessary VAT on the sales to the UK/EU based Fans and will then transmit the money directly to the appropriate tax authorities if your revenues do not exceed the VAT Threshold described in the guideline post and you are not registered for VAT. To make sure you are in compliance with your local laws depending on your particular circumstances, we advise that you obtain professional guidance.

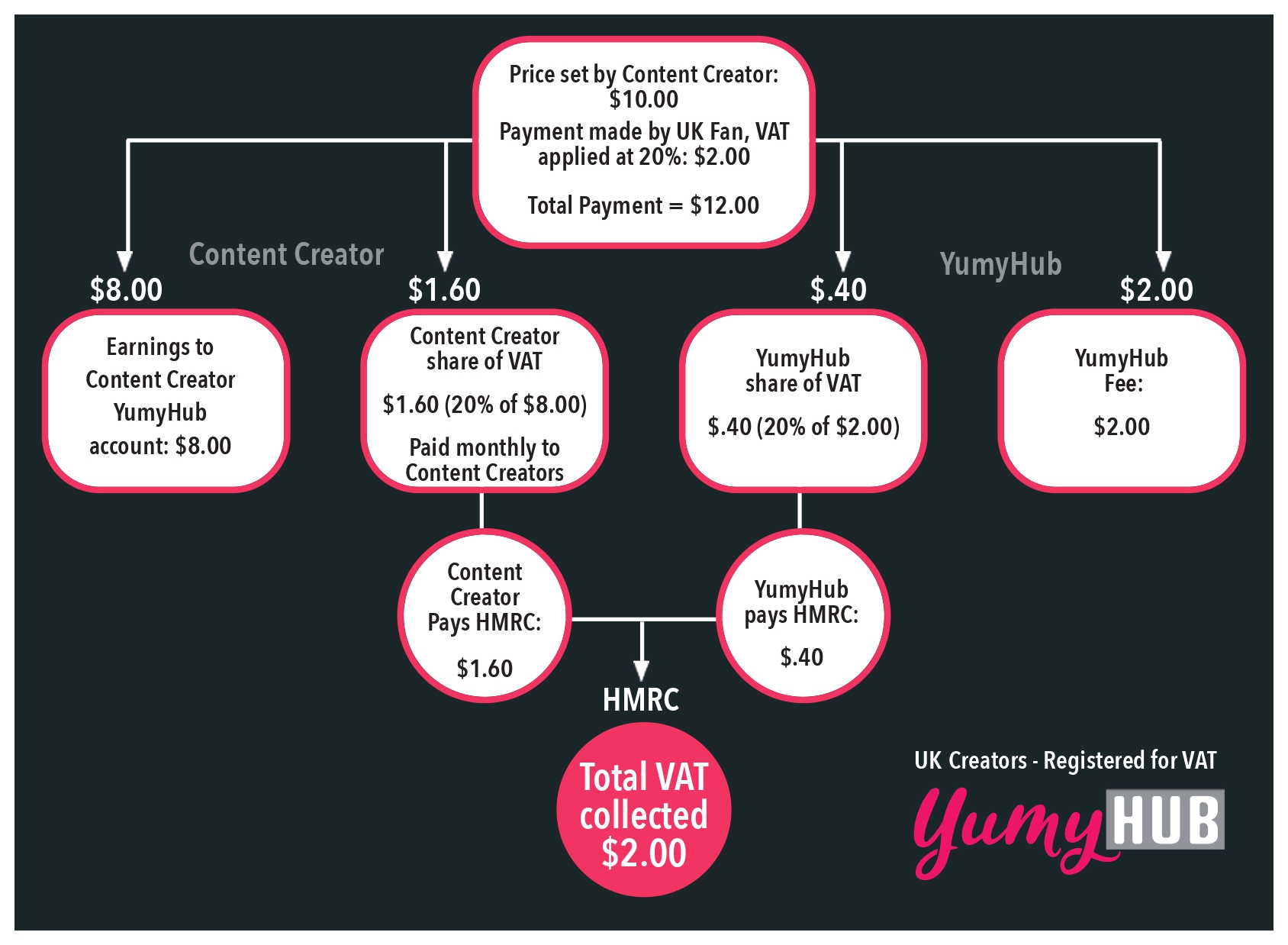

Please enter your current VAT number in the Bank (to Earn) part at https://www.yumyhub.com/my/banking/ and indicate that you agree to the self-billing agreement if you are a UK resident and have registered for VAT.

Before processing the VAT payments, we shall perform further verification steps. Creators must provide proof of their VAT file to vat@yumyhub1stg.wpenginepowered.com in order to get payment. This will be examined to make sure YumyHub Earnings’ VAT component is reported to HMRC. It will be possible to create VAT invoices after being checked.

It will be assumed that you are billing YumyHub your earnings (80% of fans’ payments) plus 20% VAT. Once internal verification processes are finished, you will be paid this VAT component that is deemed to be added to your earnings on a monthly basis in a separate payment from your usual income. There will be a printable VAT statement available to support this amount, which you can use to finish your VAT return and send YumyHub’s monthly payment of the VAT directly to HMRC.

By selecting the correct button, you can produce VAT invoices in the Statements – VAT documents area at https://www.yumyhub.com/my/banking/vat/new-document.

You may send all the invoices you need to make once you do so by clicking the Add Documents option at https://www.yumyhub.com/my/banking/vat/add-documents.

Our Accounting department will provide you the appropriate amounts to remit the VAT in accordance with the provided invoices.

For a thorough illustration of how VAT will be handled for UK VAT registered Creators who have supplied a valid VAT number, see the section below. This preserves the 80/20 earning model while ensuring that HMRC receives payment of all applicable VAT on Fan payments.